Prudential’s New PRUhealth Critical Illness Extended Care Offers Multiple Coverage on Major Diseases and Extra Protection for Removals of Benign Tumours

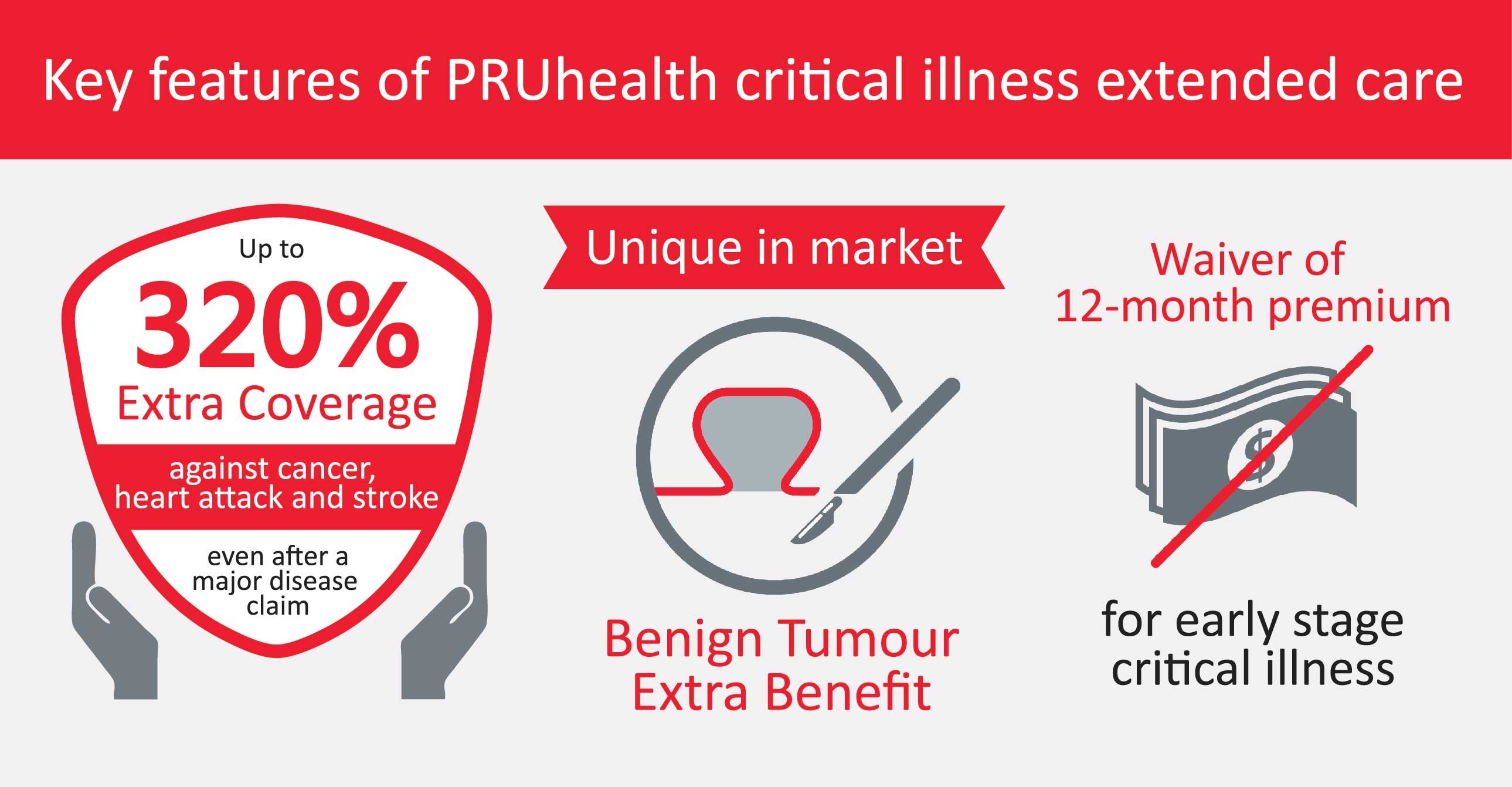

(12 April 2018, Hong Kong) Prudential Hong Kong Limited (“Prudential”) today announced the launch of PRUhealth critical illness extended care, which comes with two key features for a more comprehensive protection.The new plan, which covers 118 disease conditions,offers extended coverage of up to 320% on three of Hong Kong’s common causes of death – cancer, heart attack and stroke[1]– even after a claim for a major disease has been made. It is a unique critical illness plan in the market offering extra protection for the surgical removal of covered benign tumours. Prudential also announced its support to local social enterprise Diamond Cab to roll out the Prudential x Diamond Cab Community Rides Service as an initiative to meet the transportation needs of both chronic patients and the wheelchair-bound.

To help ease the financial burden of multiple critical illness diagnoses, PRUhealth critical illness extended care will pay out up to 80% of the sum assured for each of the two diagnoses of cancer and for each of two heart attacks or strokes[2], up to a total of 320% of the current sum assured. Such extended protection is offered even after a claim for a major disease benefit has been made.

PRUhealth critical illness extended care also provides a market unique feature of “Benign Tumour Extra Benefit”, which offers coverage for the surgical removal of an array of benign tumours – such as breast, ovary, uterus, lung, liver [3,4]. The feature is specifically designed for those with a tumour suspected by the doctor to be malignant and which can only be confirmed as benign by complete surgical removal. This will help ease the financial impact of the surgeries, including the potential loss of income, on the life assured.

Sady Wong, Senior Director, Product Management of Prudential said, “Prudential has long been dedicated to safeguarding the health, financial security and quality of life of Hong Kong people. PRUhealth critical illness extended care is designed to provide a new level of comprehensive protection. Its support to the life assured goes from benign tumour removal to multiple occurrences of a critical illness. This product represents a significant step forward in our pledge to provide comprehensive financial security for individuals in Hong Kong.”

Other major benefits of PRUhealth critical illness extended care include:

-

Covers 118 disease conditions

PRUhealth critical illness extended care offers protection against 118 disease conditions, including 56 Major Disease Conditions, 61 Early Stage Major Disease Conditions and 1 Benign Disease Condition.

-

Premium waiver after an early stage major disease claim or a major disease claim

Once the Early Stage Major Disease Benefit of a PRUhealth critical illness extended care plan has been paid, the premiums of the plan due in the next 12 months will be waived. And once the Major Disease Benefit has been paid, all future premiums of the policy for continuous protection until the life assured reaches age 86 (age next birthday) will be waived.

-

Covers against disease conditions related to congenital diseases or developmental disorders

PRUhealth critical illness extended care covers disease conditions related to congenital diseases or developmental disorders, if these congenital diseases or developmental disorders or their signs and symptoms are undetected before the policy is issued and within the first 90 days after the issuance.

-

50% extra protection for a major disease claim or death claim within the first 10 years

For added protection, PRUhealth critical illness extended care offers the critical illness care enhancer which includes a one-off extra 50% of the current sum assured of a plan for the Major Disease Benefit claim or death claim within the first 10 years of the plan for the life assured.

PRUhealth critical illness extended care is underwritten by Prudential Hong Kong Limited (“Prudential”). For further details and the terms and conditions of this plan, customers can ask Prudential for a sample of the policy document.

Prudential x Diamond Cab Community Rides Service for chronic patients and the wheelchair-bound in Hong Kong

Separately, in line with its commitment to providing comprehensive protection to those in need, Prudential also announced its support to social enterprise Diamond Cab in the introduction of the Prudential x Diamond Cab Community Rides Service, an initiative to help chronic patients and the wheelchair-bound mitigate their challenges and make their lives easier.

Prudential x Diamond Cab Community Rides Service will commence on 1 May 2018 and run until the end of this year. During the period, the service will be available on one out of five weekdays and both Saturday and Sunday, accommodating the demand for convenient and accessible transportation from those in need – whether they need to attend doctor visits or treatment sessions, or simply a Sunday yum-cha with their family.

Derek Yung, Chief Executive Officer of Prudential said, “Transportation needs for those who are suffering from illnesses or physically challenged can be much greater than we imagine. Prudential is pleased to offer our support to Diamond Cab to roll out the Prudential x Diamond Cab Community Rides Service to assist them with their daily travel needs. This echoes our commitment to listening to, and understanding, the needs of the people of Hong Kong and their loved ones, and being with them throughout their life journey.”

Francis Ngai, Founder & CEO, Social Ventures Hong Kong and Director, Diamond Cab said, “The demand for barrier-free transportation service for wheelchair users is significant, and yet not all of these people or their family have the privilege to afford a cab service. The partnership with Prudential will surely extend Diamond Cab’s service to more chronic patients and the physically disabled, providing them with transportation support for their medical appointments and weekend leisure activities as well as helping them lead a more socially inclusive life.”

[1] Source: Department of Health website: Leading cause of all deaths in 2016

[2] Before the life assured reaches age 86 (age next birthday)

[3] Extra 5% of current sum assured for surgical excision of covered benign tumour of breast, ovary or uterus (only endometrial polyps are covered)

[4] Extra 10% of current sum assured for surgical excision of covered benign tumour of adrenal gland, bone, kidney, liver, lung, nerve in cranium or spine, pancreas, pituitary gland or testis

Prudential announced the launch of PRUhealth critical illness extended care, unveiling three key product features: market unique “Benign Tumour Extra Benefit”, extended coverage of up to 320% on cancer, heart attack and stroke, as well as premium waiver of 12 months after an early stage major disease claim. (From left) Dr. Frank Yau, Medical Director of Prudential, Derek Yung, CEO of Prudential and Sady Wong, Senior Director, Product Management of Prudential, officiate at the launch event today.

Derek Yung, CEO of Prudential (right) and Francis Ngai, Founder & CEO of Social Ventures Hong Kong and Director of Diamond Cab (left), jointly announced the rollout of Prudential x Diamond Cab Community Rides Service today. The initiative echoes Prudential’s commitment to offering comprehensive support to the people of Hong Kong and their loved ones, and being with them throughout their life journey.

Prudential supports Diamond Cab to roll out the community-wide Prudential x Diamond Cab Community Rides Service in support of transportation needs of the wheelchair-bound and patients with chronic illness. Derek Yung, CEO of Prudential (right) was joined by Francis Ngai, Founder & CEO of Social Ventures Hong Kong and Director of Diamond Cab (left) to unveil the taxi at the launch event today.