Prudential Longevity Resilience Survey:

92% underestimate lifespan by 10.6 years on average, while just one-fifth of Hong Kong people nearing retirement are prepared

Brand new Evergreen Wealth Income Plan diversify the risk of living longer without income and allows your loving legacy to span over a century

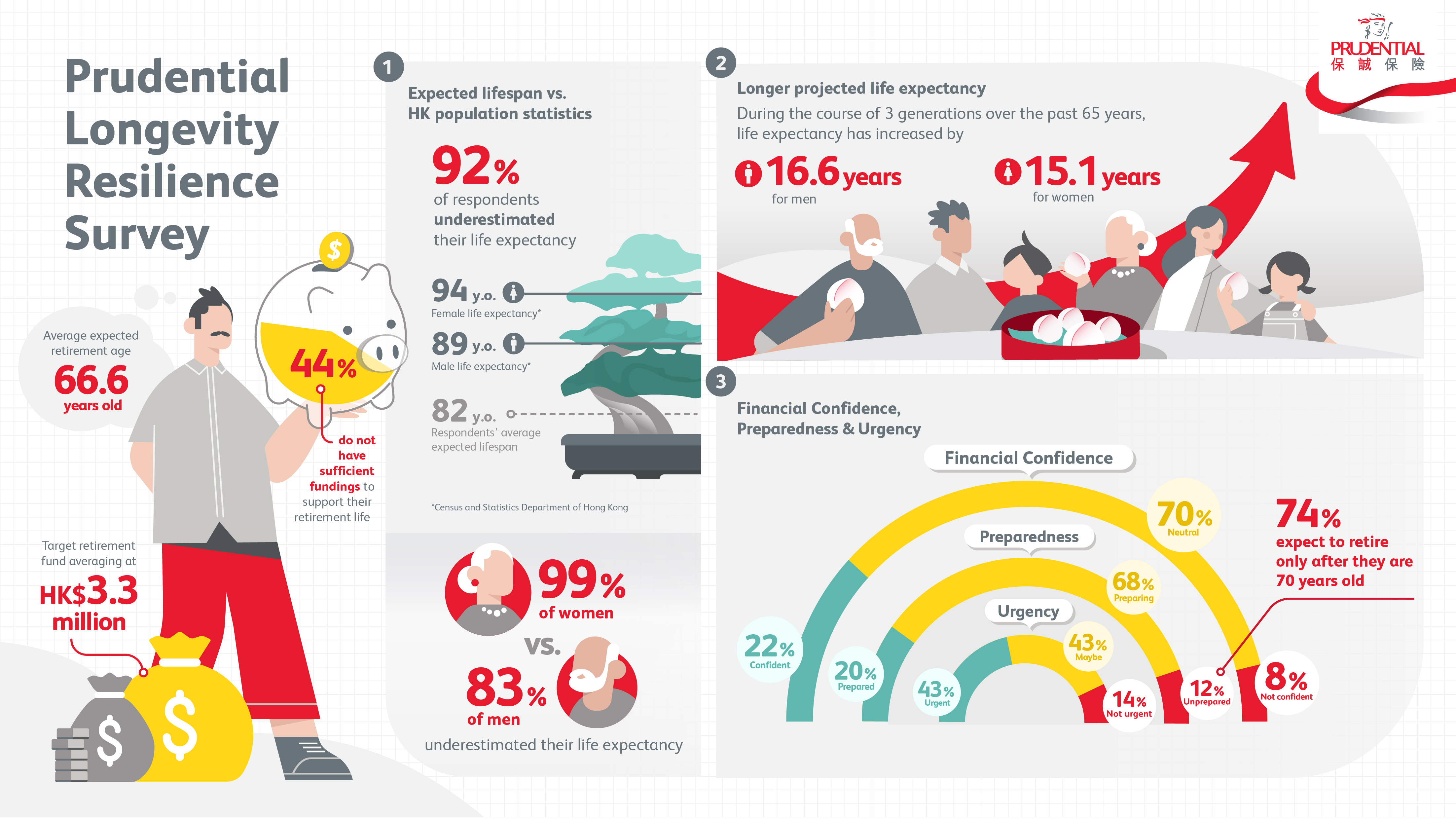

(27 September 2022, Hong Kong) Prudential Hong Kong Limited ("Prudential") today released the findings from its "Prudential Longevity Resilience Survey"1, revealing that nearly 40% of respondents in their "Golden Decade" (aged 50-60) have just started planning, or are yet to start preparing for retirement, while a whopping 92% underestimate their life expectancy on average by 10.6 years, suggesting they may also underestimate the risks of living longer.

Over 90% underestimate their life expectancy, especially women; only around 40% of respondents acknowledge the urgency of retirement planning

The findings show that less than half (43%) of those surveyed see an urgent need for retirement planning. Over a third (36%) of those who will retire in less than ten years have just started such planning, reflecting a lack of understanding about its urgency for their future well-being.

Noteworthy too is that when compared with average life expectancy data from the Census and Statistics Department of the HKSAR Government, more than nine-in-ten of respondents (92%) underestimate their lifespan. While 83% of the male respondents underestimate their life expectancy by 8 years on average (81 years old versus 89 years old according to government statistics), nearly all female respondents (99%) expect a shorter life than is shown to be the case, by an average of 12 years (82 years versus 94 years). Their overly conservative lifespan expectations exacerbate already inadequate retirement planning.

When asked about the prospect of living longer than expected, only 13% of respondents said they would be worried about their retirement life, while 63% expected to have to cut expenditure and foresee lower living standards in retirement.

Target retirement funds average at HK$3.3 million; nearly half of those surveyed have insufficient funding to support for retirement unconfident in supporting their retirement life financially

Most of the survey respondents expect to retire at age 66.6 and are targeting HK$3.3 million in savings to support them in retirement. Yet just 15% of respondents think they have prepared sufficiently for retirement and are confident about supporting their retirement life financially. However, more than two fifths (44%) do not have enough funds to cover their retirement expenses, with close to a quarter (21%) of respondents not having reached even half of their target retirement reserves at the time of the survey.

The respondents highlight in particular being underprepared with regard to medical insurance that offers good protection (only 42% are prepared) and making financial arrangements for retirement life (only 39% are prepared).

Findings highlights

Underestimation of life expectancy

- 92% of respondents underestimate their life expectancy on average by 10.6 years

- 83% of the male respondents underestimate their life expectancy by 8 years

- Nearly all female respondents (99%) expect a shorter life than is shown to be the case, by an average of 12 years

Insufficient retirement planning

- Only 15% of respondents think they have well prepared for retirement and are confident in supporting their retirement life financially

- Nearly half (44%) of the surveyed do not have enough funds to cover retirement expenses

- 21% of respondents have not yet reached half their target retirement reserves at the time of the survey

- Respondents highlight in particular being underprepared with regard to having medical insurance that offers good protection (42%) and financial arrangement for retirement life (39%)

Negligence of urgency of retirement planning

- More than half (58%) of those surveyed do not see an urgent need for retirement planning

- 36% of those who will retire in less than ten years have just started preparing for retirement

Lack of retirement planning akin to "naked resignation"* from life;

New Evergreen plan offers hedge against longevity risk in retirement planning

Priscilla Ng, Chief Marketing and Partnership Distribution Officer, Prudential Hong Kong Limited, said, "With the longer average lifespan comes a greater desire to make flexible and independent decisions for our retirement life. While young people may seem to be more ready to face the risks of an unbalanced budget or less flexible cash flow in the short-term, a retirement life without financial planning is akin to a 'naked resignation' from life itself – leaving little protection with no monthly income, a lower quality of life, and reduced capacity to provide protection for our loved ones."

Ng continued, "According to statistics by the Hong Kong Census and Statistics Department, every generation lives longer than the previous generation, increasing the longevity risk that people are often not aware of. Prudential’s brand-new Evergreen Wealth Income plan is designed to help people hedge against precisely such a risk, so that their loving legacy can span over a century to help their posterity build a more robust foundation for the future."

Designed with the company’s "We DO Family" spirit to provide protection to more families by meeting their needs in wealth preservation and inheritance, the Evergreen Wealth Income Plan helps grow wealth steadily with the disbursements of monthly income payable through to the would-be age 151 of the initial life assured – it can be passed on to future generations. The new plan serves the purpose of both wealth accumulation and delivering cash on monthly basis. The brand-new Evergreen Wealth Income Plan will be officially launched 3 October.

Featuring Jeffrey Ngai and Kenny Wong in latest promotional video

Officially debuting on 3 October, Prudential’s promotional video on its new Evergreen Wealth Income protection plan will feature two generations of iconic male idols, Jeffrey Ngai and Kenny Wong Tak-bun. The intricate timeline ties into a heartwarming ending, accentuating Prudential’s commitment to protecting the families of its customers by empowering love transcending through time. The promo video is the first time Jeffrey and Kenny have collaborated to promote an insurance product, yet the two bonded quickly through their shared passion for music.

* A trending metaphor in Hong Kong referring to a worker who resigns from their job without a backup plan or even worrying about what comes next.

1 Prudential conducted a survey in September 2022, where a total of 306 Hong Kong citizens who are working aged between 50 and 60 years (Golden Decade before getting retired) were interviewed.

- The End -

Disclaimer

Evergreen Wealth Income is underwritten by Prudential Hong Kong Limited. This document does not contain the full terms and conditions of this plan and is for reference only. You should read carefully the risk disclosures and key exclusions (if any) contained in the product brochure. For further details and the terms and conditions of this plan, customers can ask Prudential for a sample of the policy document. This document is for distribution in Hong Kong only. It is not an offer to sell or solicitation to buy or provide any insurance product outside Hong Kong. Prudential does not offer or sell any insurance product in any jurisdictions outside Hong Kong where such offering or sale of the insurance product is illegal under the laws of such jurisdictions.

About Prudential Hong Kong Limited

Prudential has been serving the people of Hong Kong since 1964. Through Prudential Hong Kong Limited and Prudential General Insurance Hong Kong Limited, we provide a range of financial planning services and products including individual life insurance, investment-linked insurance, retirement solutions, health and medical protection, general insurance, and employee benefits.

www.prudential.com.hk

About Prudential plc

Prudential plc provides life and health insurance and asset management in Asia and Africa. The business helps people get the most out of life, by making healthcare affordable and accessible and by promoting financial inclusion. Prudential protects people’s wealth, helps them grow their assets, and empowers them to save for their goals. The business has more than 19 million life customers and is listed on stock exchanges in London (PRU), Hong Kong (2378), Singapore (K6S) and New York (PUK). Prudential is not affiliated in any manner with Prudential Financial, Inc. a company whose principal place of business is in the United States of America, nor with The Prudential Assurance Company Limited, a subsidiary of M&G plc, a company incorporated in the United Kingdom.

https://www.prudentialplc.com/.