Prudential expands beneficiary definitions for ALL life insurance policies to meet the evolving protection needs of diverse family structures

- Extends SmartAppoint Service to help customers appoint more diverse types of family members as the Designated Person to file a claim with greater flexibility

- Broadens the scope of beneficiary relationships for all life insurance policies to cover more diverse family relationships in modern times, hence expanding a more comprehensive protection net

(23 December 2021, Hong Kong) Prudential Hong Kong Limited (“Prudential”) has always been committed to helping customers get the most out of life. With our purpose to lead the insurance industry in making protection more accessible for more people, Prudential is launching a series of initiatives designed to meet different market needs in Hong Kong while also extending its comprehensive protection net.

Integrating diversity and inclusion into insurance services to provide more personalised protection options for a diverse range of family members

As society evolves, family structures and living arrangements are becoming more diverse over time. Family members of various relationships, such as grandparents and grandchildren, nephews or nieces, stepchildren, same-sex or opposite-sex finace/fiancée and spouses, may now live together under the same roof. The protection needs of these family members are becoming more unique and important than ever.

In response to market demand, Prudential is expanding its beneficiary definitions for insurance policies to offer more tailored protection options for different people in need.

“As one of the pioneers in championing diversity and inclusion in the insurance industry, Prudential is providing more options for customers to include various family members or people in different relationships, in addition to immediate family members, as beneficiaries of all life insurance policies for the first time,” said Priscilla Ng, Chief Marketing and Partnership Distribution Officer at Prudential. ‘It demonstrates our commitment to providing all-round protection for family members with different needs, as a way to drive the industry to infuse diversity and inclusion into their products and services.”

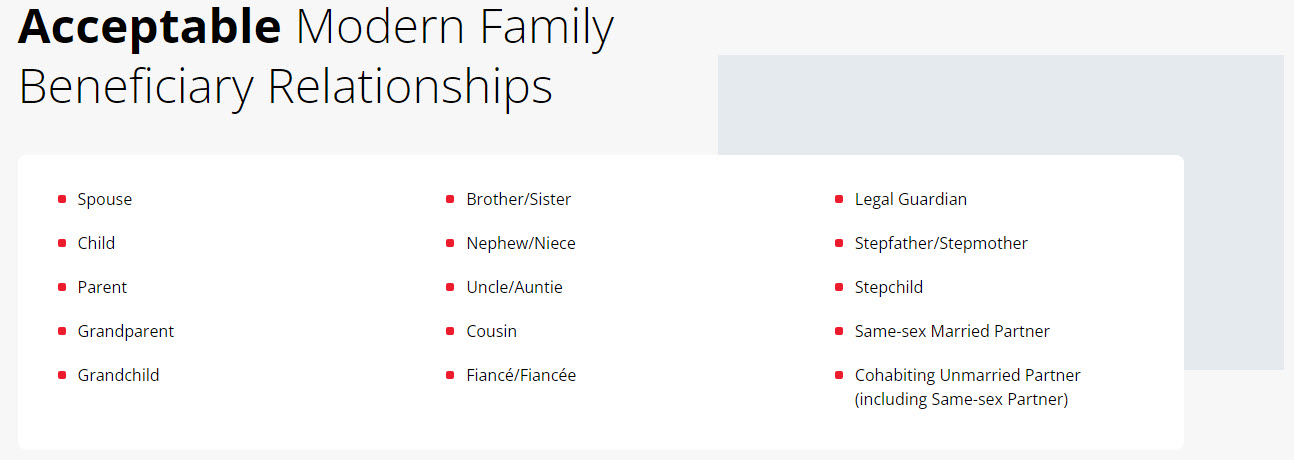

Starting today, Prudential’s life insurance customers can nominate a more diverse range of family members as their beneficiaries, such as same-sex or opposite-sex fiancé/fiancée and spouses, grandparents, grandchildren, cousins, nephews and nieces, stepchildren, and stepparents, as well as legal guardians, etc. (see appendix for further details).

This arrangement also applies to the SmartAppoint Service launched earlier. Customers can appoint a family member as a Designated Person ahead of time. Should the policyholder unfortunately face mental incapacitation due to sicknesses or unforeseen circumstances, the Designated Person can help file a claim and access the claim payment to pay for medical and daily expenses.

Women lead 46% of roles at director level or above

Cultivating an empowering culture of diversity and inclusion is one of the core values at Prudential, where women head up 46% of roles at director level or above. This demonstrated our unwavering commitment to equality, and to celebrate the diversity not only with our customers but also the workforce and the community.

In order to nurture a more inclusive working environment, Prudential offers flexible work arrangements and dedicated facilities for working mothers, pregnant women and specially abled colleagues in the office, empowering employees with discrete talents to balance family, work and personal needs, enabling them to give full play to their strengths.

With talent representing views from different departments, Prudential’s Diversity and Inclusion Committee continually explores ways to satisfy unmet customer needs by integrating diversity and inclusion ethos into different insurance products.

Prudential also joined more than 80 companies across Asia and Europe to take part in Pink Friday in November. With the “We Do” spirit, employees expressed their support for inclusion by dressing in pink.

In addition, Prudential was one of the Platinum sponsors of the TEDxTinHauWomen event, held at the Xiqu Centre in the West Kowloon Cultural District earlier this month. Inspirational women from different fields in Hong Kong gave talks and shared their unique points of view on issues influencing the progress of gender equity.

Appendix – Eligible Relationships of diverse family

Find out more and watch the Diversity and Inclusion video series on Prudential’s official website: https://www.prudential.com.hk/en/about-prudential-hk/modern-family/index.html

- The End -

About Prudential Hong Kong Limited

Prudential has been serving the people of Hong Kong since 1964. Through Prudential Hong Kong Limited and Prudential General Insurance Hong Kong Limited, we provide a range of financial planning services and products including individual life insurance, investment-linked insurance, retirement solutions, health and medical protection, general insurance and employee benefits.

Prudential plc is an Asia-led portfolio of businesses focused on structural growth markets. The business helps people get the most out of life through life and health insurance, and retirement and asset management solutions. Prudential plc has 20 million customers and is listed on stock exchanges in London, Hong Kong, Singapore and New York.

Prudential plc is not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company, a subsidiary of M&G plc, a company incorporated in the United Kingdom.

Please visit www.prudential.com.hk for more information.