Prudential Hong Kong’s PRULife HeadStart Saver Series enables families to provide greater financial support for their children’s important life milestones

-

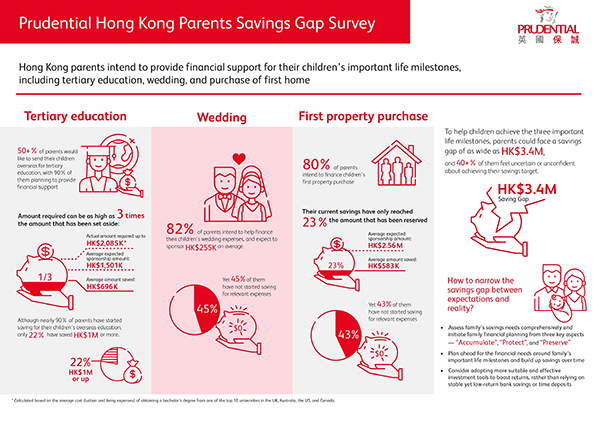

According to Prudential’s Parents Savings Gap Survey[1], Hong Kong parents are keen to help finance their children’s higher education, wedding and purchase of their first home, but face a significant savings shortfall of up to HK$3.4 million

-

Offering guaranteed cash coupons payouts and other benefits, the new Series helps families bridge the savings gap by empowering them to make an early start in building their savings for life’s major milestones, as well as protecting and preserving their wealth

(24 September 2019 – Hong Kong) Prudential Hong Kong Limited (“Prudential”) announced it will launch PRULife HeadStart Saver Series tomorrow, the Series is designed to help parents bridge the savings gap to support their children’s major milestones in life and build a solid financial future for the family. The Series offers guaranteed cash coupon payouts that will help fund their children’s higher education and enable them to accumulate wealth through whole-life savings.

“At Prudential, we are committed to supporting customers build a healthier and more secure future. We believe that it is essential for families to have an early start in accumulating wealth so as to achieve their life goals, protecting their loved ones against risk and unforeseen incidents, as well as preserving their wealth and legacy for the next generation,” said Derek Yung, Chief Executive Officer of Prudential.

“Our unique suite of savings and protection solutions, value-added services and comprehensive resources underpin our proactive role in addressing the unmet and evolving needs of families in Hong Kong, as we work towards empowering parents to give their children the best start in life and plan for a bright future,” he added.

Prudential’s Parents Savings Gap Survey sought to identify the gaps in the preparations undertaken by parents to support their children financially through major life milestones. The study found that:

-

Overall savings gap: Hong Kong parents are keen to finance their children’s major life milestones such as their education, wedding and purchase of their first home; yet they are facing a shortfall of up to HK$3.4 million to meet the cost.

-

Tertiary education: The total amount required to complete a bachelor’s degree abroad can be as high as three times the amount parents have put aside for their children’s education.

-

Wedding and property purchase: More than 40% of parents who plan to financially support their children for their wedding and property purchase have yet to put any money aside for these milestones.

-

Continuous support beyond young adulthood: Over half of the surveyed parents would like to continue providing financial support to their children in addition to their tertiary education, wedding and a property purchase, with one-third planning to support their children beyond the age of 25.

-

Investment tools: Bank savings and time deposits are the most popular investment vehicles used by the surveyed parents in accumulating wealth for their children.

Priscilla Ng, Chief Customer and Marketing Officer at Prudential, said, “Our survey shows that Hong Kong parents want to do the best they can to financially support their children. However, not only are many of them financially unprepared to do so, with more than 40% lacking confidence in achieving their savings goals. PRULife HeadStart Saver Series is a trusted vehicle for parents to manage their finances required to support their children in their life journey, from tertiary education to marriage, and more.”

PRULife HeadStart Saver Series gives customers the flexibility to tailor their savings plan. Through PRULife HeadStart Education Saver, policyholders can opt to receive four guaranteed cash coupon payments, one on each policy anniversary following the child’s 18th, 19th, 20th and 21st birthday. Alternatively, PRULife HeadStart Dream Saver offers a single guaranteed payment on the 20th policy anniversary.

PRULife HeadStart Saver Series is also designed to deliver benefits after the guaranteed cash coupon payouts, by offering policyholders potential returns through a guaranteed cash value and non-guaranteed Terminal Dividend, which allow them further accumulate wealth and boost their long-term savings.

Other key features of PRULife HeadStart Saver Series include:

-

Premium payment period of either five or 10 years

-

Parental premium waiver benefit, without requiring medical underwriting, to waive future basic premiums for continuous protection in the unfortunate event that the policyholder or his/ her spouse passes away

-

Complimentary Academic Success Award if the child meets specific educational achievements

-

Guaranteed Insurability Option to take out a new whole-life insurance plan with cash value when the child reaches the age of 21, with no health information needed

-

Choice of a range of supplementary benefits

PRULife HeadStart Saver Series is underwritten by Prudential Hong Kong Limited. For further details and the terms and conditions of this plan, customers can ask Prudential for a sample of the policy document.

To empower parents to better prepare and build a sound financial foundation for the family and their children, Prudential will be launching the WE DO FAMILY mini-site on 25 September. It will feature insights and tools on family wealth management, children’s education and health and protection to help customers plan ahead. Until 27 November 2019, customers can also win a HK$500 premium discount promotion code to redeem against the value of the newly launched PRULife HeadStart Saver Series by taking part in quizzes on the mini-site and sharing the results on Facebook or WhatsApp. For details, please visit prudential.com.hk/family.

[1] Prudential’s Parents Savings Gap Survey was conducted by ABN Impact in July 2019, 753 parents were interviewed.